Free Sample Printable Donation Receipt Template Form

A donation receipt template is suitable for making your donations easier. These are customized templates that can be used multiple times. This will help you keep a track of the number of donations made. Donation receipt templates are essential to begin a charity. This keeps things sorted and helps avoid any kind of hassle. This will also fulfill the requirement of the person who chooses to donate to the charity. A receipt in return is like a token of thanking them. Here is an article with a popular donation receipt form template example.

Donation Receipt Template Format in Word

Microsoft Word has a number of default templates for receipts. This can be used for sales, travel entries, donations, and much more. This is a simple way to customize receipts for your charity organization. There is a collection of templates that you can choose from on Word.

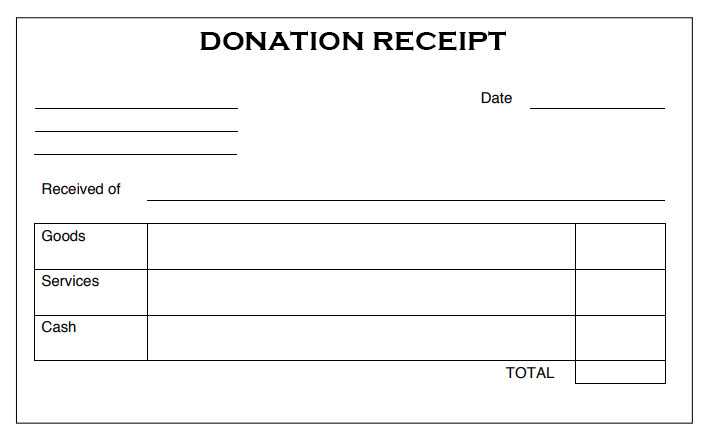

Sample Donation Receipt Form Template Examples

Check these sample donation forms to get an idea to create your own. An ideal donation receipt form template must include the following.

- Name of the organization

- Name of the donor

- Date of donation

- Amount of donation

- List of items donated and its value

Here are a few examples to consider.

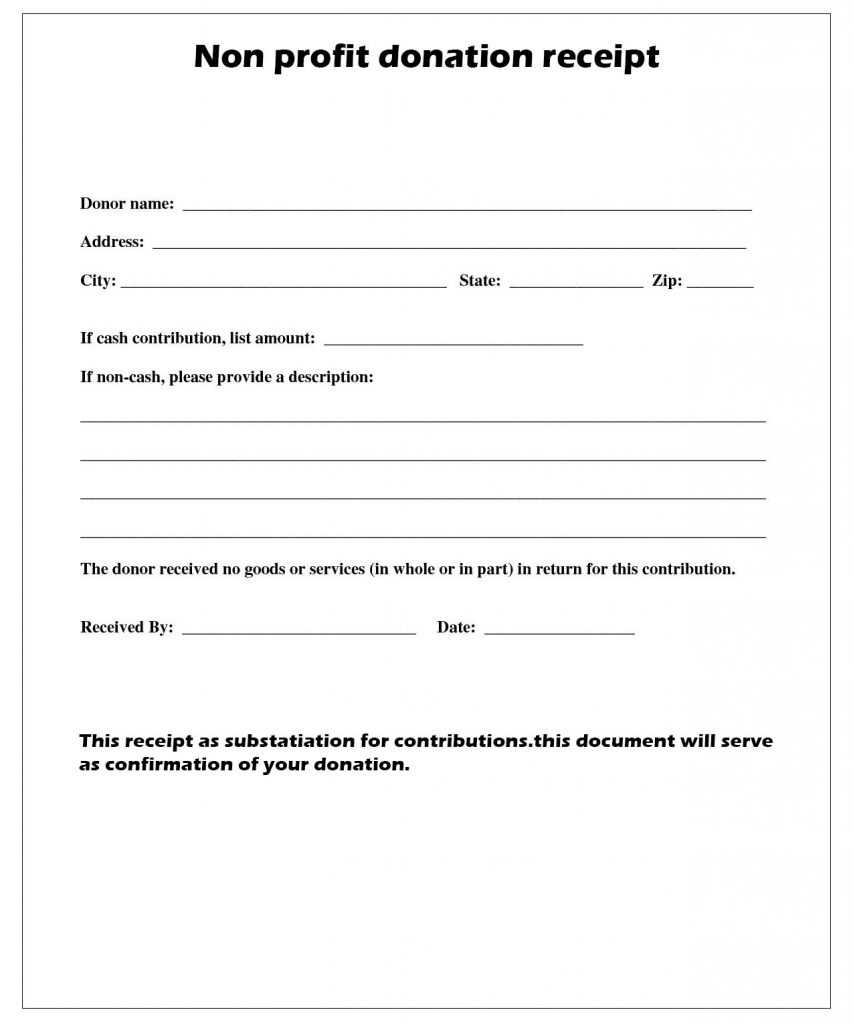

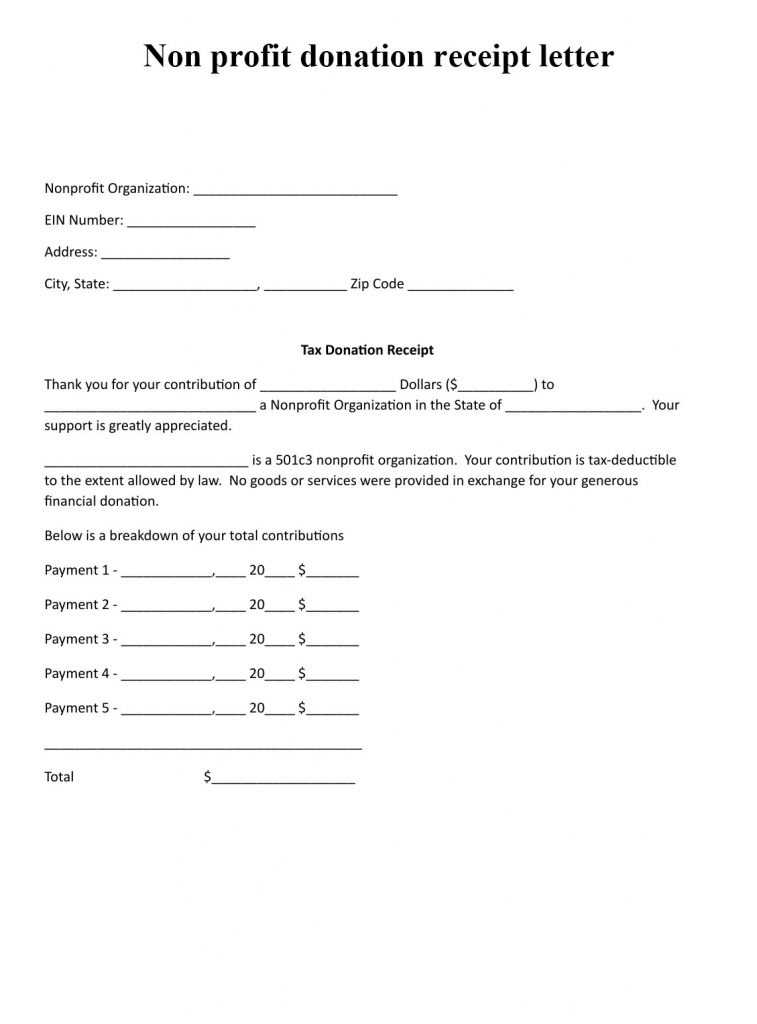

Non Profit Donation Receipt Letter

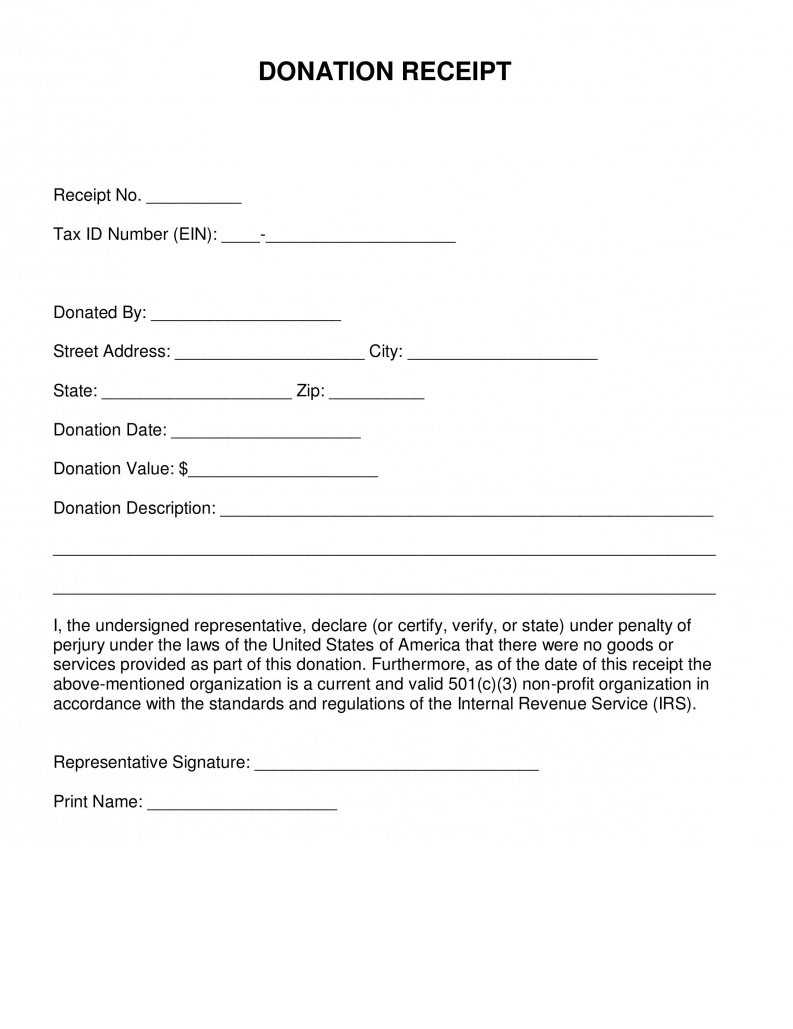

People prefer to donate money or goods to a non-profit organization. The organization will be working on several social causes and the money will be used to uplift the society. This donation receipt template for nonprofits includes important information like the taxes associated, donor, and organization details.

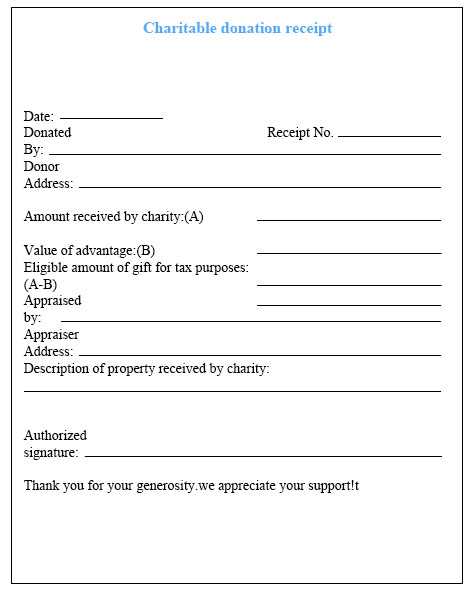

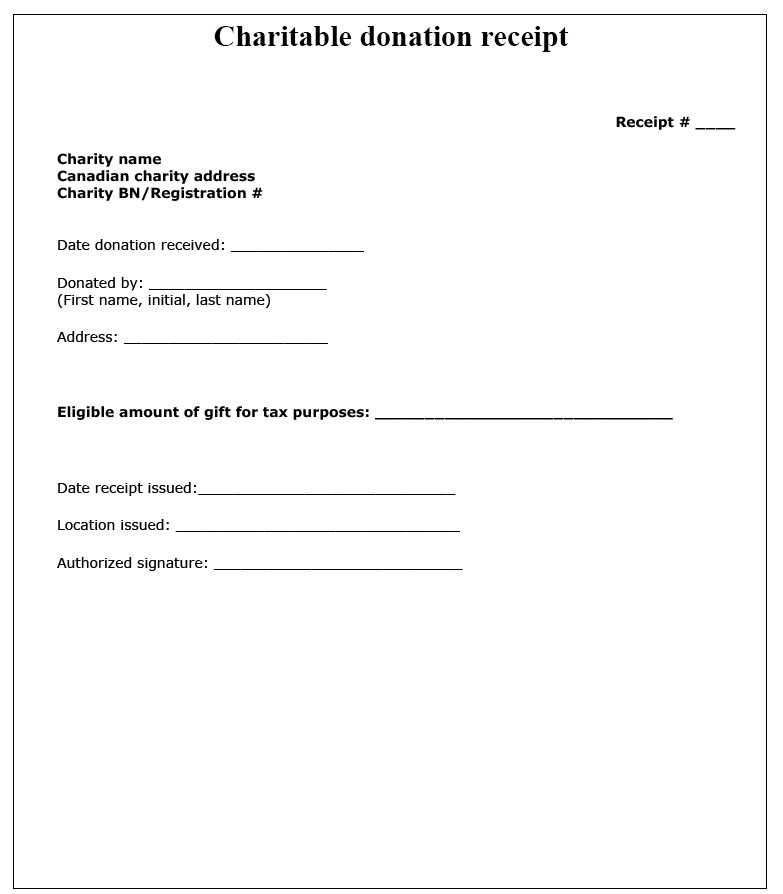

Charitable Donation Receipt Template

Charity donations can be based on religious norms or any other type. There are many types of charities. The donation receipt tax record form for a charity must verify the authenticity of the organization too. Only then the donations can be produced as a record of tax. The form should act as evidence of the contribution made by the donor. The type of contribution and authorized signature of the organization's representative made its value.

Sample Donation Receipt Template

A donation receipt template is customized as an email. This can also be produced as a letter. This is essential for the donor to deduct tax based on the donation made to an organization. An acknowledgment by the charity is also essential to label it as a valid donation. This could be in the form of a signature or seal.

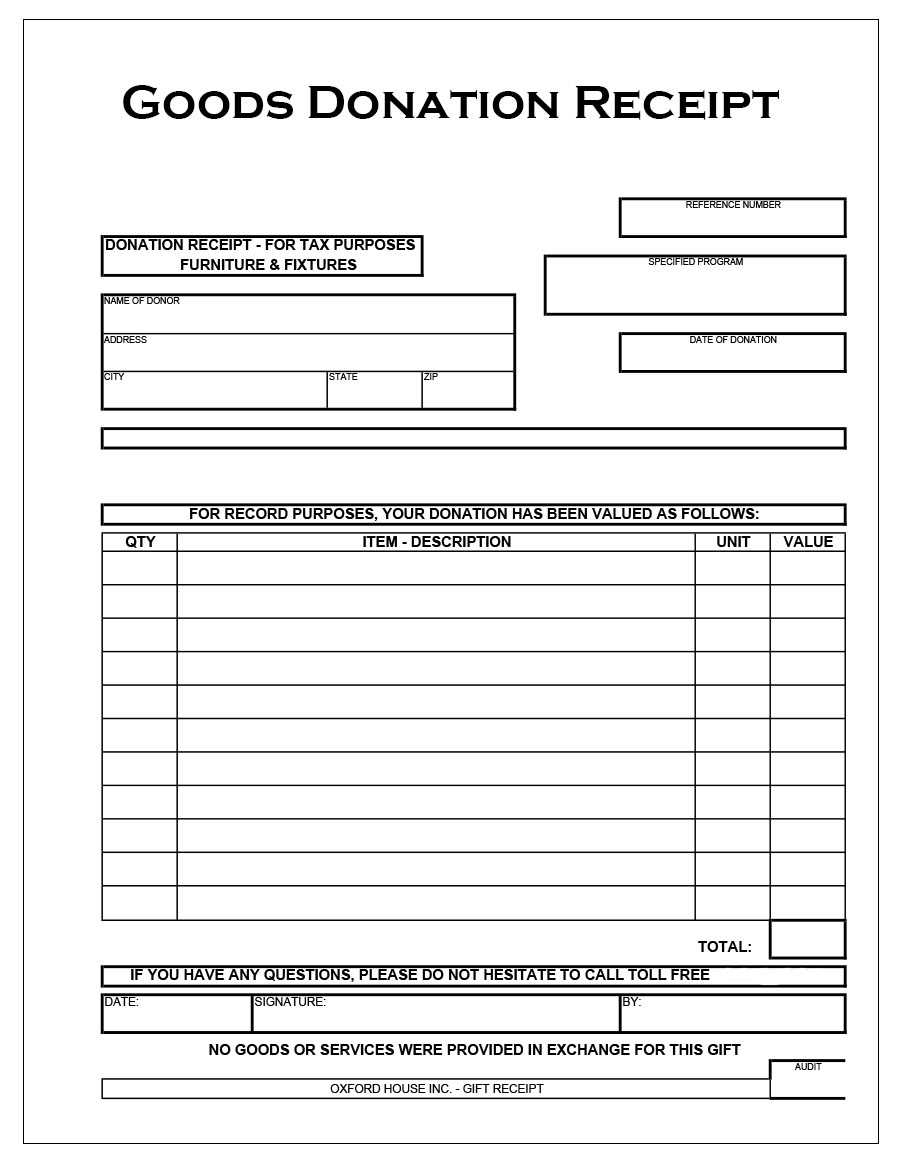

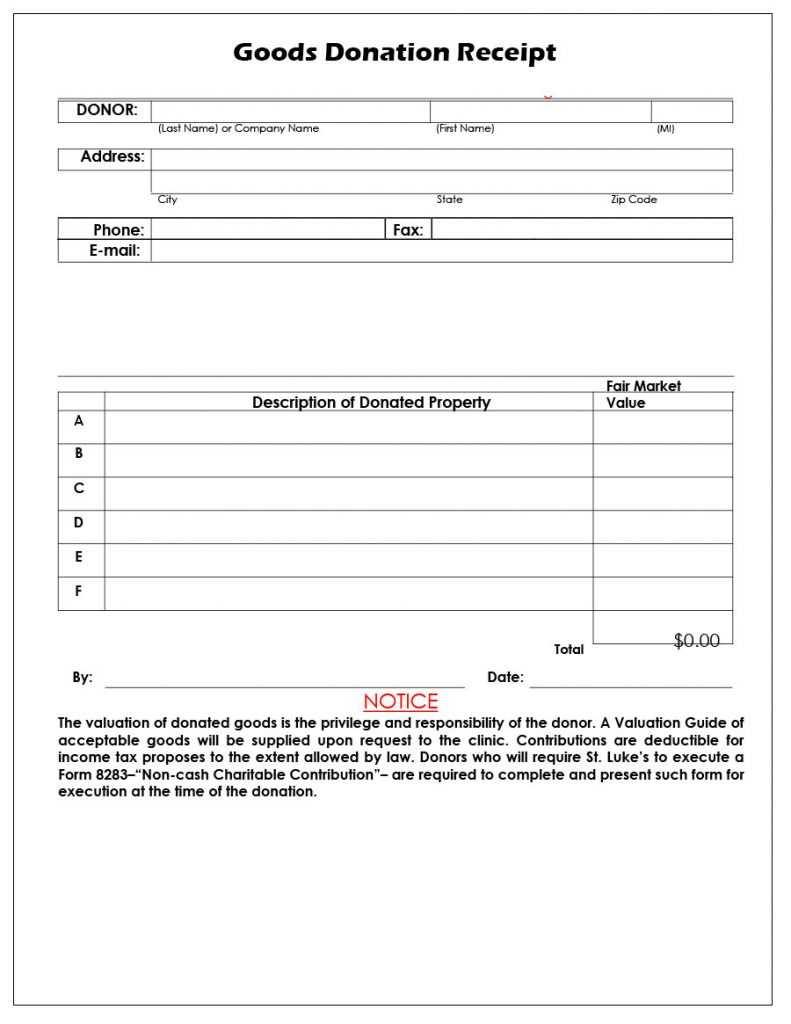

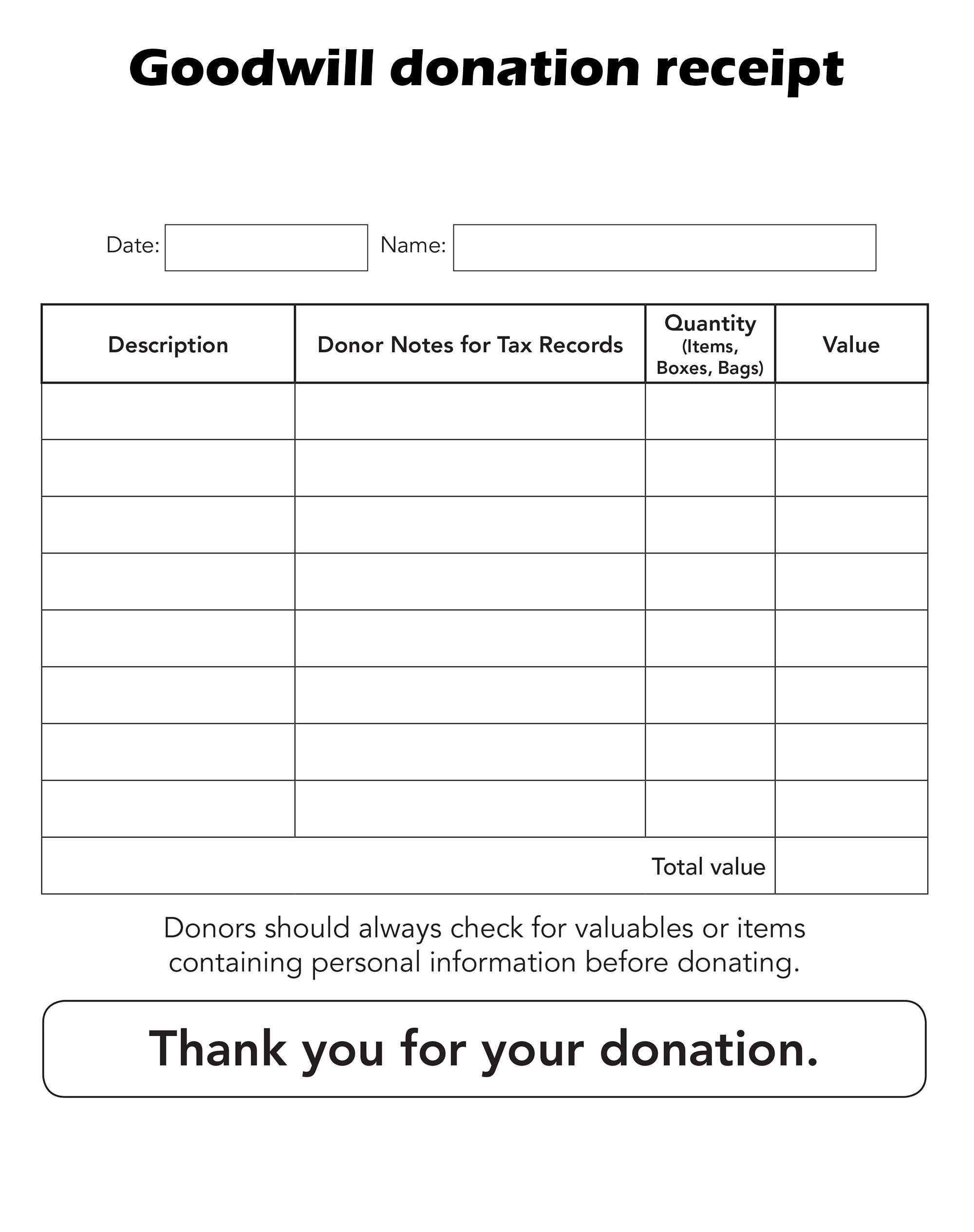

Goods Donation Receipt Template

Contributions to organizations will not only be in the form of monetary funds. It can come from useful goods. So, the donation receipt template should include a checkbox whether the donation is money or good. Such donations need to be valued by the organization. This is for the mutual benefits of both the donor and the charity.

Tax Donation Receipt Form

All donations are not meant for a tax deduction. Only eligible organizations as per the rules of the IRS can avail of the deduction. It is always convenient to use customized templates as tax donation receipt forms may be used frequently. Especially, for large contributions from donors, for example, a donation of more than $250 issuing the receipt is essential.

IRS Donation Receipt Form

Charitable organizations are part of the Internal Revenue Service (IRS). According to the IRS, the donation receipt forms must include a set of information. This also sets laws to ensure the legal functioning of every organization. All charities must issue a receipt to the donor. The forms must provide a value for goods contributed. These are not meant to be deductible by the charity as they are provided by the donor.

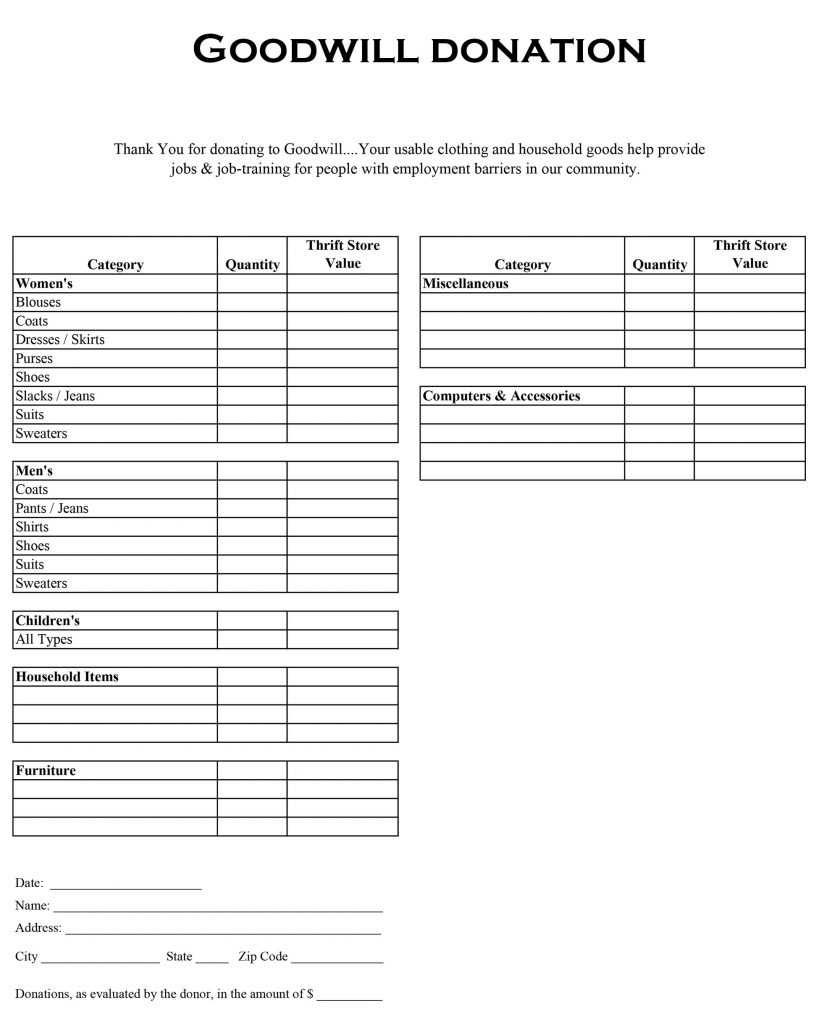

Goodwill Donation Receipt Form

Goodwill is a donation center to donate items that have taxes. This includes clothing accessories and household items. The donation receipt form for Goodwill includes a value for each item donated. The donor information along with the tax information is present. For the Goodwill associate record, the staff member acknowledges the donation made with a signature.

Cash Donation Tax Form

Cash is the most convenient way of donating. This can be donated as a check, electronic fund transfer, credit/debit card transfer, and payroll deduction too. For the donation to be eligible for the tax deduction, the amount must be equal to or less than 60% of the donor's AGI. That is why issuing a cash donation tax form is important. This is further used as evidence to get a tax deduction. Without a form, this donation is considered invalid.

Conclusion

These are the popular types of donation receipt forms. These can be printed by a charity organization and issued to every donor. This makes the donation valid and establishes the charity as a trustworthy organization. It ensures the donor to utilize deducted tax donations. This is applicable for all non-profit groups, religious organizations, and service organizations.

Related Posts

Free Blank Printable Tax Receipt Template with Example in PDF

Free Printable Cash Receipt Template PDF, Word & Excel

About The Author

Letter Team

The team behind BestLetterTemplate.com understands the importance of effective communication in today's professional world and strive to provide you with the tools you need to make a lasting impression. Our team of experienced writers has created a wide range of templates for common letters, including recommendations, resignations, and cover letters. All of our templates are completely free to use and are designed to save you time and hassle. Whether you're a student, a recent graduate, or a seasoned professional, we've got you covered.